Access Key CISO Comp Data and Trends: Our CISO Comp Report is Live!

Following an active market for CISOs in 2021 and 2022, the demand for top security talent softened in 2023 and remained calm through the first half of 2024. During that period, many companies tightened budgets and adopted more cautious hiring practices, resulting in a quieter market with reduced CISO rotation and fewer aggressive counteroffers.

In this piece, we’re breaking down three compelling data points from our 2024 CISO Compensation Benchmark Report. Our fifth annual CISO compensation benchmark study, jointly fielded with Artico Search, offers objective insights and cross-industry compensation survey results from over 755 CISOs across the U.S. and Canada.

CISO Merit Increases Drives 6.4% Wage Growth Top Reasons for the Most Recent Annual Comp Increases

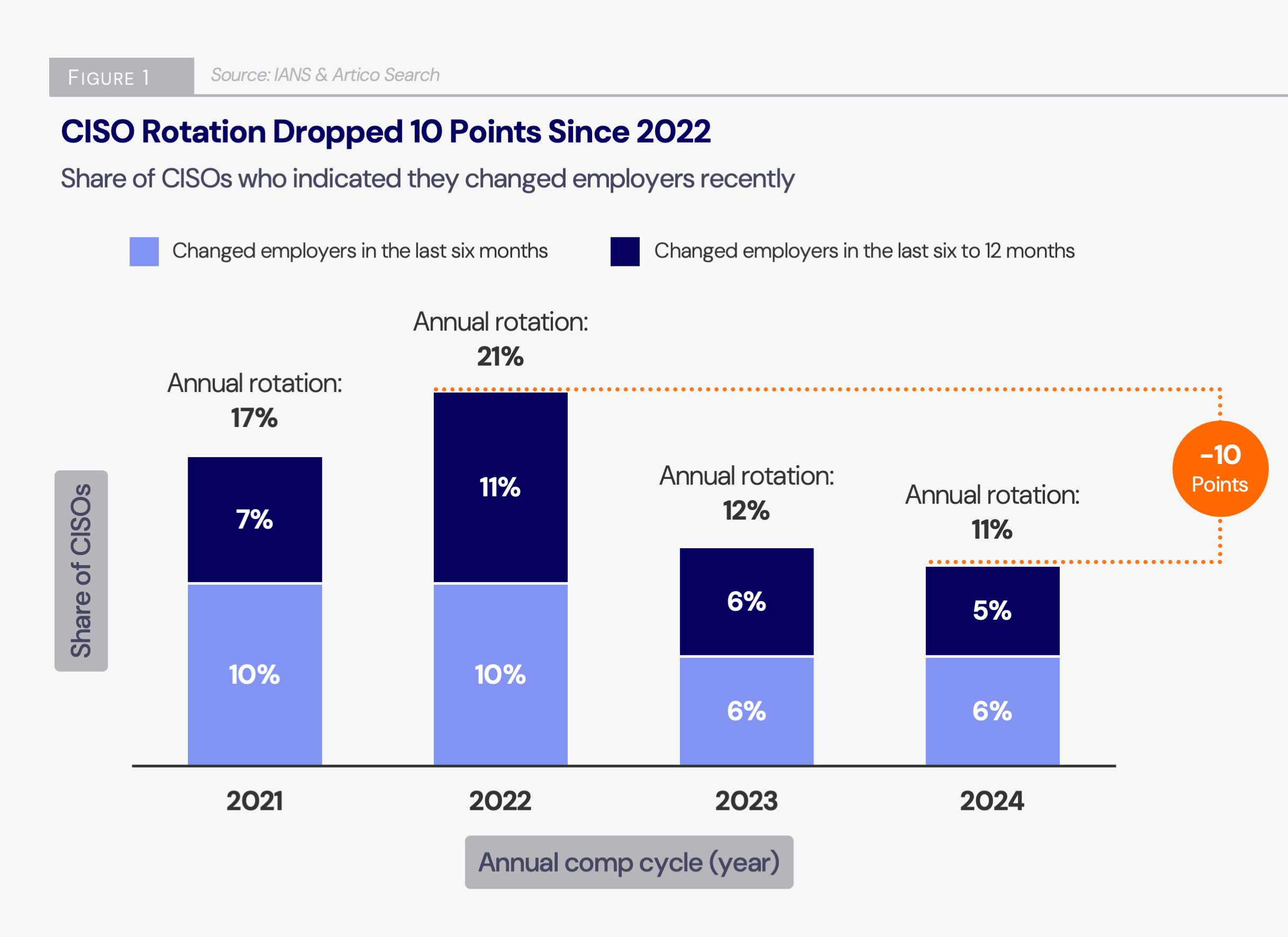

The past 12 months have been quiet in terms of CISOs transitioning to new companies. Just 11% of survey respondents changed employers, similar to the CISO turnover rate in 2023 and in stark contrast to 2022, when 21% of CISOs made a job switch (see Figure 1).

With reduced market movement, employers generally feel less pressure to raise wages to attract or retain talent.

IANS Faculty Steve Martano, also a partner in Artico Search’s cyber practice comments on the current state of CISO talent market: “People have asked about salary depression in the security function but we see no evidence of it. We are seeing modest increases, mostly merit increases, as CISOs are not changing jobs in large numbers like we’ve seen in previous years. Although the market is improving quarter-after-quarter, we are far from the previous environment where CISOs regularly entertained multiple offers and counteroffers.”

Top Reasons for the Most Recent Annual Comp Increases

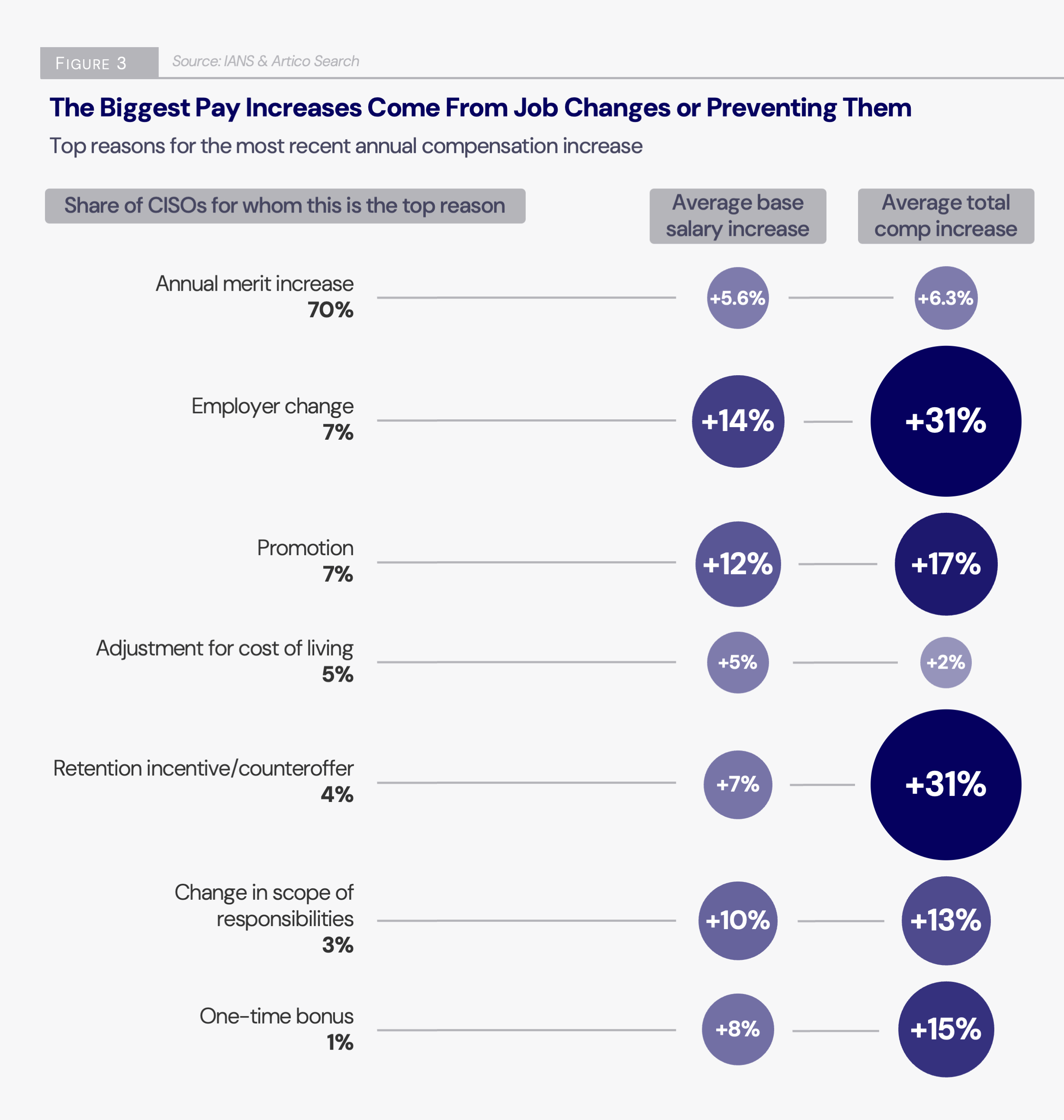

For 70% of CISOs, their latest comp increase was primarily merit-based. That leaves 30% of CISOs who indicated their wages grew for other reasons. Figure 3 illustrates these reasons in a bubble chart, with the percentage of CISOs citing each reason as the top reason on the left side and the average comp increase shown on the right. The size of the bubbles represents the magnitude of the increase.

The largest average increases are linked to an employer change incentive or a retention incentive/counteroffer, in each case resulting in a 31% average boost to total compensation. This is followed by a promotion, one-time bonus and a change in scope of responsibilities.

CISOs Citing Employer Change or Retention Incentives Dropped

The 3-year trend for CISOs who reported that changing employers or retention incentives were the primary drivers of their compensation increases reinforces the relative calm in the market observed in the CISO movement data presented earlier in the report (see Figure 5).

The average size of employer-change pay increases and retention-incentives was impacted less over the same period. In 2022, CISOs reported a total comp boost of 37% for changing employers and 19% increases associated with retention offers, versus 31% and 31% in 2024, respectively.

CISO Compensation & Security Budget Benchmark Reports

Each year, IANS, in partnership with Artico Search, releases a series of benchmark reports on CISO compensation, security budgets, security organization, security staff compensation, and job satisfaction. These in-depth reports feature new takeaways, uncover a wealth of insights, and provide valuable leadership guidance to fine-tune your current role, department, and career path.

Download our 2024 CISO Compensation Benchmark Report – the second in our CISO Comp and Budget Report series – and gain access to these and other valuable insights and data sets.

Although reasonable efforts will be made to ensure the completeness and accuracy of the information contained in our blog posts, no liability can be accepted by IANS or our Faculty members for the results of any actions taken by individuals or firms in connection with such information, opinions, or advice.